- Home

- MediaOutReach

- Cyber and Supply Chain Risks Reshaping Japan's Business Landscape, Aon Survey

Cyber and Supply Chain Risks Reshaping Japan's Business Landscape, Aon Survey

Kamis, 12 Februari 2026 | 12:12

TOKYO, JAPAN -

Media OutReach Newswire

- 12 February 2026 - Aon plc (NYSE: AON), a leading global professional

services firm, has released the Japan findings of its 2025 Global Risk

Management Survey. The survey reveals that Japanese businesses are

navigating a complex landscape marked by persistent cyber threats,

supply chain disruptions and weather/natural disasters. The survey,

which gathered insights from nearly 3,000 risk managers, C-suite leaders

and executives across 63 countries, highlights the unique risks Japan

businesses are facing amid global disruption.

Japan's Top Risks:

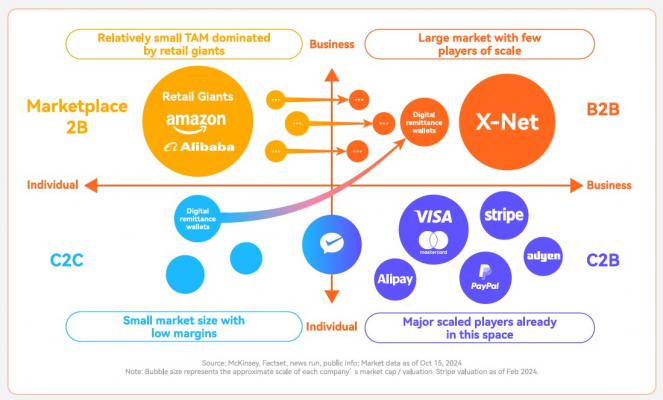

"Cyber Attacks/Data Breach" remains the top risk for Japanese businesses, consistent with global trends. "Supply chain or distribution failure" ranks second, as extreme weather events and mounting geopolitical volatility including shifting trade policies force companies to reassess their supply chains. In addition, "Product Liability/Recall" and "Exchange Rate Fluctuation" pose significant risks, reflecting the country's manufacturing strength and exposure to global market volatility. Notably, 63.6 percent of Japanese respondents reported losses due to product liability or recall issues and 47.6 percent cited losses from exchange rate fluctuations.

Tatsuya Yamamoto, CEO of Japan at Aon, said, "Japanese organisations are operating in an environment of unprecedented complexity. Cyber, weather and geopolitical risks continue to be acute challenges for Japan businesses, underscoring the need for robust risk management frameworks and agile strategies. As market trends shift and competition intensifies, vigilance and adaptability will be key. The interconnectedness of risks – where a cyber attack can disrupt supply chains or geopolitical volatility can trigger regulatory changes – demands a holistic, proactive approach to resilience."

2025 Top 10 Business Risks in Japan

Japanese organisations demonstrate a strong commitment to risk management, with 74.7 percent having a formal risk management and insurance department, compared to 68.4 percent globally. Additionally, 75.3 percent measure the total cost of insurable risk and 83.3 percent report that these costs are increasing. While risk awareness is rising, most organisations have yet to quantify their exposures or leverage advanced analytics.

Japanese Businesses Risk Management Assessments for Top Three Risks

For "Cyber Attacks/Data Breaches":

Looking ahead, Japanese organisations expect "Weather/Natural Disasters" and "Geopolitical Volatility" to remain critical risks, alongside "Rapidly Changing Market Trends," which is more prominent in Japan than globally. This highlights the country's exposure to climate events and evolving consumer preferences.

Japan's Top Five Future Business Risks by 2028:

To access the full report and explore how Aon is helping clients navigate today's disruption dynamic, visit Global Risk Management Survey Japan

Japan's Top Risks:

"Cyber Attacks/Data Breach" remains the top risk for Japanese businesses, consistent with global trends. "Supply chain or distribution failure" ranks second, as extreme weather events and mounting geopolitical volatility including shifting trade policies force companies to reassess their supply chains. In addition, "Product Liability/Recall" and "Exchange Rate Fluctuation" pose significant risks, reflecting the country's manufacturing strength and exposure to global market volatility. Notably, 63.6 percent of Japanese respondents reported losses due to product liability or recall issues and 47.6 percent cited losses from exchange rate fluctuations.

Tatsuya Yamamoto, CEO of Japan at Aon, said, "Japanese organisations are operating in an environment of unprecedented complexity. Cyber, weather and geopolitical risks continue to be acute challenges for Japan businesses, underscoring the need for robust risk management frameworks and agile strategies. As market trends shift and competition intensifies, vigilance and adaptability will be key. The interconnectedness of risks – where a cyber attack can disrupt supply chains or geopolitical volatility can trigger regulatory changes – demands a holistic, proactive approach to resilience."

2025 Top 10 Business Risks in Japan

- Cyber Attacks/Data Breach

- Supply Chain or Distribution Failure

- Weather/Natural Disasters

- Geopolitical Volatility

- Business Interruption

- Economic Slowdown/Slow Recovery

- Exchange Rate Fluctuation

- Commodity Price Risk/Scarcity of Materials

- Product Liability/Recall

- Failure to Attract or Retain Top Talent

Japanese organisations demonstrate a strong commitment to risk management, with 74.7 percent having a formal risk management and insurance department, compared to 68.4 percent globally. Additionally, 75.3 percent measure the total cost of insurable risk and 83.3 percent report that these costs are increasing. While risk awareness is rising, most organisations have yet to quantify their exposures or leverage advanced analytics.

Japanese Businesses Risk Management Assessments for Top Three Risks

For "Cyber Attacks/Data Breaches":

- 27.2 percent have assessed the risk

- 12.6 percent have developed continuity plans

- 22.3 Percent have risk management plans

- 25 percent have assessed the risk

- 20 percent have developed continuity plans

- 26.7 Percent have risk management plans

- 24.1 percent have assessed the risk

- 22.4 percent have developed continuity plans

- 13.8 percent have risk management plans

Looking ahead, Japanese organisations expect "Weather/Natural Disasters" and "Geopolitical Volatility" to remain critical risks, alongside "Rapidly Changing Market Trends," which is more prominent in Japan than globally. This highlights the country's exposure to climate events and evolving consumer preferences.

Japan's Top Five Future Business Risks by 2028:

- Cyber Attacks/Data Breach

- Weather/Natural Disasters

- Geopolitical Volatility

- Rapidly Changing Market Trends

- Increasing Competition

To access the full report and explore how Aon is helping clients navigate today's disruption dynamic, visit Global Risk Management Survey Japan

BERITA LAINNYA

Kamis, 12 Februari 2026 | 12:15

Kamis, 12 Februari 2026 | 12:13

Kamis, 12 Februari 2026 | 12:13

Kamis, 12 Februari 2026 | 12:12

Kamis, 12 Februari 2026 | 12:11

Rabu, 11 Februari 2026 | 20:53

Rabu, 11 Februari 2026 | 20:52

Rabu, 11 Februari 2026 | 20:50

Rabu, 11 Februari 2026 | 20:50

Rabu, 11 Februari 2026 | 20:49

Rabu, 11 Februari 2026 | 20:48