- Home

- MediaOutReach

- Act Now or Lose Ground: Mr. Angad Banga of The Caravel Group Urges Global Shipping to Accelerate Green Transition

Act Now or Lose Ground: Mr. Angad Banga of The Caravel Group Urges Global Shipping to Accelerate Green Transition

Selasa, 18 November 2025 | 20:19

HONG KONG SAR -

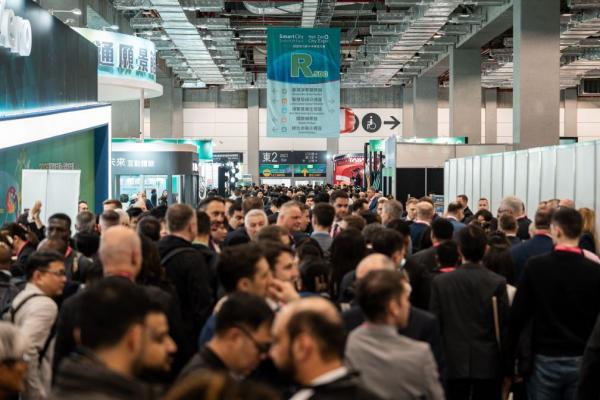

Media OutReach Newswire - 18 November 2025 - Speaking at the

World Maritime Merchants Forum during

Hong Kong Maritime Week 2025, Mr. Angad Banga, Chief Operating

Officer of The Caravel Group, the parent company of Fleet Management

Limited, and Chairman of the Hong Kong Shipowners' Association and

Chairman of the Promotion and External Relations Committee of the Hong

Kong Maritime and Port Development Board, called for urgent and

coordinated investment to accelerate the maritime industry's transition

to net-zero emissions.

"If we wait for perfect clarity, we will lose ground," Banga urged in his keynote address, "Unlocking Global Maritime Capital: Hong Kong's Role in Leading the Green Transition". He urged shipowners, regulators, and financiers to act decisively in the wake of the IMO's recent postponement of its Net-Zero Framework. "This creates a leadership opportunity — and Hong Kong is ready to lead".

Banga positioned Hong Kong as a gateway between China and the global market, combining its role as an international maritime hub and financial powerhouse to fund decarbonisation as well as explore innovative financial tools — from sustainability-linked loans to Stablecoins and the digital yuan — to drive the transition.

Infrastructure and Green Fuel Readiness

Hong Kong shipowners control nearly 10% of the global merchant fleet by deadweight tonnage, with four of the world's top 10 ship management companies headquartered in the city. Banga reaffirmed Hong Kong's push to expand capacity for alternative fuels — ammonia, methanol, hydrogen, biofuels, and LNG — supported by the Hong Kong Government's Action Plan on Green Maritime Fuel Bunkering.

By the end of Hong Kong Maritime Week, the city will have completed three LNG bunkering operations alongside cargo handling.

"Our location in the Greater Bay Area, near Mainland China's renewable fuel production hubs, gives us a unique advantage as one of the most practical and efficient green fuel supply centres," he told delegates.

Financing the Transition

Hong Kong currently ranks third globally in the Global Financial Centres Index, just narrowly behind London and New York, and facilitates over 70% of global offshore RMB payments. In 2025 alone, 80 companies went public with a pipeline of 300, while companies raised nearly US$60 billion through IPOs, placements, convertibles, and exchangeable bond offerings.

Banga stressed that infrastructure must be matched by incentives and policy certainty to support early adopters and avoid stranded assets.

"Shipping is the backbone of global trade, and decarbonisation is creating new markets for fuels, technologies, and services — all of which require capital," he said. Hong Kong's deep capital markets, record IPO activity, and strong green finance ecosystem make it uniquely placed to fund this transition.

Policy Alignment and Global Leadership

Addressing the recent postponement of the IMO's Net-Zero Framework, Banga warned that fragmented regulations such as CII, EEXI, EU ETS, and FuelEU create a "patchwork" of overlapping requirements that slow investment and risk stranded assets.

"Without clear incentives and predictable frameworks, the risk of stranded assets is real," he said, urging shipowners, regulators, and financiers to "work together to harmonise frameworks, build supply chains, and share costs."

Innovation and Digital Assets

The Hong Kong Government has issued HK$240 billion in green bonds since 2018, while the Core Climate carbon marketplace, launched in 2022, connects capital with climate action. Highlighting Hong Kong's fintech strengths, Banga pointed to potential applications for stablecoins.

"Stablecoins – digital tokens pegged to stable assets – may offer potential benefits for traceable cross‑border transactions by reducing settlement times and currency risk," he said. Integrating such tools with China's digital yuan, he added, could further enhance efficiency and transparency in maritime finance, provided compliance and security requirements are met. Concluding on the wider mission of maritime decarbonisation, Banga said: "There is no greater cause for collaboration between government and industry than this."

"If we wait for perfect clarity, we will lose ground," Banga urged in his keynote address, "Unlocking Global Maritime Capital: Hong Kong's Role in Leading the Green Transition". He urged shipowners, regulators, and financiers to act decisively in the wake of the IMO's recent postponement of its Net-Zero Framework. "This creates a leadership opportunity — and Hong Kong is ready to lead".

Banga positioned Hong Kong as a gateway between China and the global market, combining its role as an international maritime hub and financial powerhouse to fund decarbonisation as well as explore innovative financial tools — from sustainability-linked loans to Stablecoins and the digital yuan — to drive the transition.

Infrastructure and Green Fuel Readiness

Hong Kong shipowners control nearly 10% of the global merchant fleet by deadweight tonnage, with four of the world's top 10 ship management companies headquartered in the city. Banga reaffirmed Hong Kong's push to expand capacity for alternative fuels — ammonia, methanol, hydrogen, biofuels, and LNG — supported by the Hong Kong Government's Action Plan on Green Maritime Fuel Bunkering.

By the end of Hong Kong Maritime Week, the city will have completed three LNG bunkering operations alongside cargo handling.

"Our location in the Greater Bay Area, near Mainland China's renewable fuel production hubs, gives us a unique advantage as one of the most practical and efficient green fuel supply centres," he told delegates.

Financing the Transition

Hong Kong currently ranks third globally in the Global Financial Centres Index, just narrowly behind London and New York, and facilitates over 70% of global offshore RMB payments. In 2025 alone, 80 companies went public with a pipeline of 300, while companies raised nearly US$60 billion through IPOs, placements, convertibles, and exchangeable bond offerings.

Banga stressed that infrastructure must be matched by incentives and policy certainty to support early adopters and avoid stranded assets.

"Shipping is the backbone of global trade, and decarbonisation is creating new markets for fuels, technologies, and services — all of which require capital," he said. Hong Kong's deep capital markets, record IPO activity, and strong green finance ecosystem make it uniquely placed to fund this transition.

Policy Alignment and Global Leadership

Addressing the recent postponement of the IMO's Net-Zero Framework, Banga warned that fragmented regulations such as CII, EEXI, EU ETS, and FuelEU create a "patchwork" of overlapping requirements that slow investment and risk stranded assets.

"Without clear incentives and predictable frameworks, the risk of stranded assets is real," he said, urging shipowners, regulators, and financiers to "work together to harmonise frameworks, build supply chains, and share costs."

Innovation and Digital Assets

The Hong Kong Government has issued HK$240 billion in green bonds since 2018, while the Core Climate carbon marketplace, launched in 2022, connects capital with climate action. Highlighting Hong Kong's fintech strengths, Banga pointed to potential applications for stablecoins.

"Stablecoins – digital tokens pegged to stable assets – may offer potential benefits for traceable cross‑border transactions by reducing settlement times and currency risk," he said. Integrating such tools with China's digital yuan, he added, could further enhance efficiency and transparency in maritime finance, provided compliance and security requirements are met. Concluding on the wider mission of maritime decarbonisation, Banga said: "There is no greater cause for collaboration between government and industry than this."

BERITA LAINNYA

Selasa, 18 November 2025 | 20:19

Selasa, 18 November 2025 | 20:18

Selasa, 18 November 2025 | 20:17

Selasa, 18 November 2025 | 20:16

Selasa, 18 November 2025 | 20:15

Selasa, 18 November 2025 | 20:15

Selasa, 18 November 2025 | 20:14

Selasa, 18 November 2025 | 20:11

Selasa, 18 November 2025 | 20:09

Selasa, 18 November 2025 | 20:07

Selasa, 18 November 2025 | 19:56

Selasa, 18 November 2025 | 10:56