- Home

- MediaOutReach

- Hong Kong FinTech Week x StartmeupHK Festival 2025: United for decade of innovation and scaling

Hong Kong FinTech Week x StartmeupHK Festival 2025: United for decade of innovation and scaling

Selasa, 18 November 2025 | 10:56

HONG KONG SAR -

Media OutReach Newswire

- 18 November 2025 - The Hong Kong FinTech Week x StartmeupHK Festival

(HKFW x SMUF) 2025 concluded November 7, following a dynamic week of

activities that began with a two-day main conference held November 3 and

4. The event brought together government officials, regulators,

innovators, and industry leaders from around the world for a series of

panels, keynote speeches, and strategic discussions. The joint

celebration of two flagship events reaffirms Hong Kong's commitment to

advancing the digital economy.

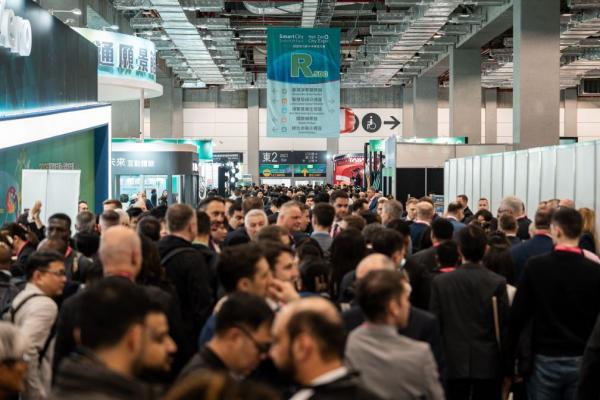

The entire week attracted a record high of over 45 000 visitors from over 120 economies and featured over 1 000 distinguished speakers, over 800 exhibitors and more than 30 Chinese Mainland and international delegations. The event was organised by the Financial Services and the Treasury Bureau, the Commerce and Economic Development Bureau and Invest Hong Kong (InvestHK), in collaboration with the Hong Kong Monetary Authority (HKMA), the Securities and Futures Commission (SFC), and the Insurance Authority (IA), and the appointed event organiser, Finoverse.

Celebrating a decade of excellence

As the inaugural convergence of the two flagship events, the Chief Executive, Mr John Lee, officiated at the opening of the main conference. The main conference showcased 11 themed forums. These included the Policy Forum, Visionary Forum, InsurTech Forum, HealthTech Forum, Wealth & Investment Management Forum, Digital Finance Forum, Digital Assets Forum, Blockchain & Web3 Forum, AI & Advanced Tech Forum, China-Global Innovation Forum, and TechX Forum.

Deputy Governor of the People's Bank of China, Mr Lu Lei, attended the main conference and highlighted the fintech collaboration between the Chinese Mainland and Hong Kong, which has driven advancements such as interoperable cross-boundary payments and e-CNY use cases, unlocking new efficiencies. He emphasised the importance of payment innovation promoting connectivity and fostering integrated economic development between the Chinese Mainland and Hong Kong. This comes as China charts its 15th Five-Year Plan and reaffirms Hong Kong's role as an international financial centre.

Mr Lu noted the continuous expansion of the RMB Cross-border Interbank Payment System (CIPS) in Hong Kong, including the launch of Hong Kong dollar clearing services as well as southbound and northbound fund settlement functions under Bond Connect.

The Financial Secretary, Mr Paul Chan, delivered a keynote address and participated in a panel discussion moderated by the Director-General of Investment Promotion of InvestHK, Ms Alpha Lau. Joining Mr Chan on the panel were the Group Chief Executive of HSBC, Mr Georges Elhedery, and the Group Chief Executive of Standard Chartered, Mr Bill Winters. With around 1 200 fintech companies in Hong Kong, Mr Chan shared three key observations from the journey in building a vibrant fintech ecosystem - financial inclusion as an objective, regulators as enablers of innovation, and responsible and sustainable innovation.

At the panel discussion "Curating the New FinTech Era", the Secretary for Financial Services and the Treasury, Mr Christopher Hui, highlighted blockchain and AI as the transformative technologies for Hong Kong's financial services. Mr Hui also noted the important role that regulatory sandboxes and subsidy programmes play in the city's fintech ecosystem. They are not only the crucial driver in cultivating innovation but also conducive to obtaining valuable views and feedback from the market for better review and enhancement to existing policy and regulatory frameworks.

The President and Chair of the Board of Directors of the Asian Infrastructure Investment Bank (AIIB), Mr Jin Liqun, attended the Main Conference and shared insights on how financial innovation can help maintain and support nature and ecological conservation. He remarked, "Once we can verify nature as an asset, we can make it investable. We can digitise and scale it to make it sustainable in the long run." He also announced the AIIB's plan to set up an office in Hong Kong to address its growing business needs.

Charging ahead with heart: policy and ecosystem perspectives

The Under Secretary for Financial Services and the Treasury, Mr Joseph Chan, engaged in an in-depth dialogue with ex-Chairman of Meitu and Angel Investor Mr Cai Wensheng at the Main Conference. Mr Chan detailed Hong Kong's latest growth in the digital asset space. Mr Chan stated that "The Government is promoting the development of digital asset in a sustainable and responsible manner. As Asia's leading international financial centre, in June 2025, we issued the Policy Statement 2.0 on the Development of Digital Assets in Hong Kong, reinforcing its commitment to establishing Hong Kong as a global hub for innovation in the digital asset field."

The Under Secretary for Innovation, Technology and Industry, Ms Lillian Cheong, in a video speech, outlined the Government's strategic investments in I&T (innovation and technology) infrastructure, talent and industry development, with a view to fostering a vibrant I&T ecosystem in the city and build Hong Kong into a new real economy. She pointed out that the Government strives to consolidate Hong Kong's strengths in I&T through a series of support measures by better co-ordinating the upstream, midstream and downstream development. She extended a sincere invitation to fintech companies and start-ups to leverage Hong Kong's unique advantages that underpins its status as a global innovation hub and set up or expand businesses in the city.

The Under Secretary for Environment and Ecology, Miss Diane Wong, delivered a keynote speech on Hong Kong's environmental and sustainability achievements to date, highlighting the pivotal role played by technological innovation under decarbonisation strategies. "To combat climate change effectively, we need to adopt appropriate measures on climate adaptation and resilience, to protect life and property of our people from the extreme weather events. AI and robots are playing an increasingly important role in these areas," she said.

Miss Wong added that the Government attaches importance to adopting innovation technologies in its work. She quoted the example of the Hong Kong Observatory, which has been running several AI models to support operational forecasting such as tropical cyclone track forecasting since mid-2023. The AI models have successfully forecast several tropical cyclones this year, to an accuracy better than traditional weather prediction models.

Shaping the future of finance through digital transformation and trust

The Chief Executive of the HKMA, Mr Eddie Yue, outlined the four strategic pillars of the HKMA's "Fintech 2030" vision: Data and Payment Infrastructure, AI, Resilience, and Tokenisation, collectively known as "DART". He stated that this strategy aims to establish Hong Kong as a robust, resilient, and future-ready fintech hub, detailing how each pillar will drive the next chapter of fintech in the city. Reflecting on the evolution of Hong Kong's fintech landscape over the past decade, he introduced the strategy for the upcoming Fintech 3.0 era, characterised by technology embedded in daily life, underpinned by trust, transparency, and intelligence to create a real-world impact and lasting resilience.

Mr Yue also noted AI's transition from an experimental phase to a significant innovation driver, with over three-quarters of the city's banks implementing or piloting AI solutions. He emphasised the importance of deeper collaboration across the industry to develop a shared and scalable AI infrastructure that would benefit the banking industry. He reaffirmed that tokenisation remains a key priority and highlighted the role of the HKMA as an enabler and facilitator in building an interoperable and trusted network, which will lay the foundation for a vibrant tokenised asset market. Lastly, Mr Yue stressed that resilience involves not just withstanding shocks, but being secure, adaptive, and future-ready in the face of new innovations.

The Chief Executive Officer of the SFC, Ms Julia Leung, opened the fireside chatby highlighting two new circulars to be issued that day (November 3). These allow Virtual Asset Trading Platforms (VATPs) to share a global order book with their overseas affiliates, connecting the Hong Kong market with global liquidity. The circulars also expand VATPs' service and product offerings in all types of digital assets.

Ms Leung also discussed the recent joint consultations by the SFC and Financial Services and the Treasury Bureau on the regulatory framework for virtual asset dealers and custodians, noting positive feedback received. She revealed plans to extend the licensing regime to include virtual asset advisory and management, with discussions underway with the Government. The new custody regime will focus on managing risks linked to private keys. The SFC expects to license only the most robust and reliable players to ensure a secure environment.

The Chief Executive Officer of the IA, Mr Clement Cheung, emphasised that the key takeaway from the technological advances in the past few years is that "development is paramount but has to be balanced with regulation". He acknowledged the rapid progress in technology development within the insurance industry, generative AI and blockchain for example, as "breathtaking". Taking a dual approach in balancing regulation and development to foster sustainability, he highlighted a series of milestone initiatives of the IA that promote the adoption of advanced technologies and strengthen operational resilience of the industry, including the Open API Framework, the Cyber Resilience Assessment Framework, and the AI Cohort Programme. He also announced the publication of the Whitepaper on Federated Learning.

Mr Cheung stressed that as the insurance sector evolves, regulators must navigate in a balanced and enlightened manner to promote inclusive and responsible innovation.

Collaboration is key: redefining the innovation frontier

Frontier technology, from biotech and fintech to AI and Web3, was the centre of celebration as companies and start-ups took to various stages and panels to discuss what they have been able to achieve in the space.

Nobel Laureate in Physics, Professor Emeritus of the University of Toronto, Mr Geoffrey Hinton, shared at the event the future of AI. Professor Hinton introduced his groundbreaking "Mother AI" theory, emphasising the importance of ensuring AI genuinely cares for humanity rather than replacing it. He outlined strategies to mitigate AI-related risks and highlighted opportunities to foster innovation aligned with human values amid rapid technological advancement, while underscoring Asia's key role in driving AI innovation.

Co-founder and Managing Partner of DST Global Mr John Lindfors and the Founding Managing Partner of Qiming Venture Partners, Mr Duane Kuang, joined the forum session to exchange insights on how disruptive technologies are reshaping global growth opportunities. They shared perspectives on the rapid maturation of innovation - from AI and biotech to digital assets - into scalable, investable markets, and highlighted how new investment vehicles are opening greater access for investors worldwide.

The President and Chief Executive Officer of Franklin Templeton, Ms Jenny Johnson, predicted that the next wave of major companies will emerge from the AI and crypto innovation. She emphasised that while AI and blockchain are transformative, the biggest challenge is organisational change management, where start-ups adapt faster than incumbents. Ms Johnson noted that current AI investment gains are concentrated among infrastructure providers such as chipmakers and cloud services, but future growth will come as firms learn to expand margins using AI. She also highlighted real-world crypto and NFT (non-fungible token) applications, such as luxury goods authentication and bandwidth sharing, and praised Hong Kong's progressive blockchain regulation as a model for innovation.

The President of the Solana Foundation, Ms Lily Liu, discussed how digital asset treasury (DATs) and ETFs (exchange-traded funds) are complementary tools for traditional investors, but stressed the need to filter them for long-term quality amid speculative cycles. She highlighted how the evolution of technologies such as stablecoins reflects a broader transformation in financial infrastructure, where decentralised platforms increasingly play a central role in profit generation and capital flow. On another panel, Co-Executive Director of the Ethereum Foundation Mr Tomasz Stańczak, emphasised stablecoins' role in improving cross-border payments and driving institutional interest in tokenised assets.

During the main conference, a series of curated media tours highlighted Hong Kong's role as a global financial and innovation hub. Key moments included exclusive sessions with Chinese Mainland tech giants. Tencent introduced its vision for cross-boundary payment services; WeBank focused on HQ-driven innovation; and Ant Digital Technologies underscored Hong Kong's strategic advantages for global expansion and cutting-edge fintech solutions. Other tours showcased Hong Kong as a "super connector" for emerging markets with delegations led by the Dubai International Financial Centre and the National Innovation Agency of Thailand. Another tour positioned Hong Kong as a launch pad for Chinese Mainland firms to go global, featuring the Shenzhen Financial Techology Association and the Zhongguancun Financial Technology Industry Development Alliance.

Marking the conclusion of the HKFW x SMUF 2025, Ms Lau, said, "The unprecedented success of the HKFW x SMUF 2025 speaks volumes about the vibrancy, depth and resilience of our financial innovation and start-up ecosystem. We are grateful to all our partners, speakers and participants from around the world who came together to make this our largest and most impactful edition yet. As we look to the next decade, InvestHK remains steadfast in our commitment to connect global companies with Hong Kong's dynamic ecosystem, empowering them to scale across Asia and beyond, driving innovation, commercialisation, and creating more cross-border collaboration opportunities."

For more details and highlights from HKFW x SMUF 2025, please visit www.fintechweek.hk, or follow via the official social media accounts:

LinkedIn: Hong Kong FinTech Week; and

YouTube: www.youtube.com/c/HongKongFinTechWeek.

The entire week attracted a record high of over 45 000 visitors from over 120 economies and featured over 1 000 distinguished speakers, over 800 exhibitors and more than 30 Chinese Mainland and international delegations. The event was organised by the Financial Services and the Treasury Bureau, the Commerce and Economic Development Bureau and Invest Hong Kong (InvestHK), in collaboration with the Hong Kong Monetary Authority (HKMA), the Securities and Futures Commission (SFC), and the Insurance Authority (IA), and the appointed event organiser, Finoverse.

Celebrating a decade of excellence

As the inaugural convergence of the two flagship events, the Chief Executive, Mr John Lee, officiated at the opening of the main conference. The main conference showcased 11 themed forums. These included the Policy Forum, Visionary Forum, InsurTech Forum, HealthTech Forum, Wealth & Investment Management Forum, Digital Finance Forum, Digital Assets Forum, Blockchain & Web3 Forum, AI & Advanced Tech Forum, China-Global Innovation Forum, and TechX Forum.

Deputy Governor of the People's Bank of China, Mr Lu Lei, attended the main conference and highlighted the fintech collaboration between the Chinese Mainland and Hong Kong, which has driven advancements such as interoperable cross-boundary payments and e-CNY use cases, unlocking new efficiencies. He emphasised the importance of payment innovation promoting connectivity and fostering integrated economic development between the Chinese Mainland and Hong Kong. This comes as China charts its 15th Five-Year Plan and reaffirms Hong Kong's role as an international financial centre.

Mr Lu noted the continuous expansion of the RMB Cross-border Interbank Payment System (CIPS) in Hong Kong, including the launch of Hong Kong dollar clearing services as well as southbound and northbound fund settlement functions under Bond Connect.

The Financial Secretary, Mr Paul Chan, delivered a keynote address and participated in a panel discussion moderated by the Director-General of Investment Promotion of InvestHK, Ms Alpha Lau. Joining Mr Chan on the panel were the Group Chief Executive of HSBC, Mr Georges Elhedery, and the Group Chief Executive of Standard Chartered, Mr Bill Winters. With around 1 200 fintech companies in Hong Kong, Mr Chan shared three key observations from the journey in building a vibrant fintech ecosystem - financial inclusion as an objective, regulators as enablers of innovation, and responsible and sustainable innovation.

At the panel discussion "Curating the New FinTech Era", the Secretary for Financial Services and the Treasury, Mr Christopher Hui, highlighted blockchain and AI as the transformative technologies for Hong Kong's financial services. Mr Hui also noted the important role that regulatory sandboxes and subsidy programmes play in the city's fintech ecosystem. They are not only the crucial driver in cultivating innovation but also conducive to obtaining valuable views and feedback from the market for better review and enhancement to existing policy and regulatory frameworks.

The President and Chair of the Board of Directors of the Asian Infrastructure Investment Bank (AIIB), Mr Jin Liqun, attended the Main Conference and shared insights on how financial innovation can help maintain and support nature and ecological conservation. He remarked, "Once we can verify nature as an asset, we can make it investable. We can digitise and scale it to make it sustainable in the long run." He also announced the AIIB's plan to set up an office in Hong Kong to address its growing business needs.

Charging ahead with heart: policy and ecosystem perspectives

The Under Secretary for Financial Services and the Treasury, Mr Joseph Chan, engaged in an in-depth dialogue with ex-Chairman of Meitu and Angel Investor Mr Cai Wensheng at the Main Conference. Mr Chan detailed Hong Kong's latest growth in the digital asset space. Mr Chan stated that "The Government is promoting the development of digital asset in a sustainable and responsible manner. As Asia's leading international financial centre, in June 2025, we issued the Policy Statement 2.0 on the Development of Digital Assets in Hong Kong, reinforcing its commitment to establishing Hong Kong as a global hub for innovation in the digital asset field."

The Under Secretary for Innovation, Technology and Industry, Ms Lillian Cheong, in a video speech, outlined the Government's strategic investments in I&T (innovation and technology) infrastructure, talent and industry development, with a view to fostering a vibrant I&T ecosystem in the city and build Hong Kong into a new real economy. She pointed out that the Government strives to consolidate Hong Kong's strengths in I&T through a series of support measures by better co-ordinating the upstream, midstream and downstream development. She extended a sincere invitation to fintech companies and start-ups to leverage Hong Kong's unique advantages that underpins its status as a global innovation hub and set up or expand businesses in the city.

The Under Secretary for Environment and Ecology, Miss Diane Wong, delivered a keynote speech on Hong Kong's environmental and sustainability achievements to date, highlighting the pivotal role played by technological innovation under decarbonisation strategies. "To combat climate change effectively, we need to adopt appropriate measures on climate adaptation and resilience, to protect life and property of our people from the extreme weather events. AI and robots are playing an increasingly important role in these areas," she said.

Miss Wong added that the Government attaches importance to adopting innovation technologies in its work. She quoted the example of the Hong Kong Observatory, which has been running several AI models to support operational forecasting such as tropical cyclone track forecasting since mid-2023. The AI models have successfully forecast several tropical cyclones this year, to an accuracy better than traditional weather prediction models.

Shaping the future of finance through digital transformation and trust

The Chief Executive of the HKMA, Mr Eddie Yue, outlined the four strategic pillars of the HKMA's "Fintech 2030" vision: Data and Payment Infrastructure, AI, Resilience, and Tokenisation, collectively known as "DART". He stated that this strategy aims to establish Hong Kong as a robust, resilient, and future-ready fintech hub, detailing how each pillar will drive the next chapter of fintech in the city. Reflecting on the evolution of Hong Kong's fintech landscape over the past decade, he introduced the strategy for the upcoming Fintech 3.0 era, characterised by technology embedded in daily life, underpinned by trust, transparency, and intelligence to create a real-world impact and lasting resilience.

Mr Yue also noted AI's transition from an experimental phase to a significant innovation driver, with over three-quarters of the city's banks implementing or piloting AI solutions. He emphasised the importance of deeper collaboration across the industry to develop a shared and scalable AI infrastructure that would benefit the banking industry. He reaffirmed that tokenisation remains a key priority and highlighted the role of the HKMA as an enabler and facilitator in building an interoperable and trusted network, which will lay the foundation for a vibrant tokenised asset market. Lastly, Mr Yue stressed that resilience involves not just withstanding shocks, but being secure, adaptive, and future-ready in the face of new innovations.

The Chief Executive Officer of the SFC, Ms Julia Leung, opened the fireside chatby highlighting two new circulars to be issued that day (November 3). These allow Virtual Asset Trading Platforms (VATPs) to share a global order book with their overseas affiliates, connecting the Hong Kong market with global liquidity. The circulars also expand VATPs' service and product offerings in all types of digital assets.

Ms Leung also discussed the recent joint consultations by the SFC and Financial Services and the Treasury Bureau on the regulatory framework for virtual asset dealers and custodians, noting positive feedback received. She revealed plans to extend the licensing regime to include virtual asset advisory and management, with discussions underway with the Government. The new custody regime will focus on managing risks linked to private keys. The SFC expects to license only the most robust and reliable players to ensure a secure environment.

The Chief Executive Officer of the IA, Mr Clement Cheung, emphasised that the key takeaway from the technological advances in the past few years is that "development is paramount but has to be balanced with regulation". He acknowledged the rapid progress in technology development within the insurance industry, generative AI and blockchain for example, as "breathtaking". Taking a dual approach in balancing regulation and development to foster sustainability, he highlighted a series of milestone initiatives of the IA that promote the adoption of advanced technologies and strengthen operational resilience of the industry, including the Open API Framework, the Cyber Resilience Assessment Framework, and the AI Cohort Programme. He also announced the publication of the Whitepaper on Federated Learning.

Mr Cheung stressed that as the insurance sector evolves, regulators must navigate in a balanced and enlightened manner to promote inclusive and responsible innovation.

Collaboration is key: redefining the innovation frontier

Frontier technology, from biotech and fintech to AI and Web3, was the centre of celebration as companies and start-ups took to various stages and panels to discuss what they have been able to achieve in the space.

Nobel Laureate in Physics, Professor Emeritus of the University of Toronto, Mr Geoffrey Hinton, shared at the event the future of AI. Professor Hinton introduced his groundbreaking "Mother AI" theory, emphasising the importance of ensuring AI genuinely cares for humanity rather than replacing it. He outlined strategies to mitigate AI-related risks and highlighted opportunities to foster innovation aligned with human values amid rapid technological advancement, while underscoring Asia's key role in driving AI innovation.

Co-founder and Managing Partner of DST Global Mr John Lindfors and the Founding Managing Partner of Qiming Venture Partners, Mr Duane Kuang, joined the forum session to exchange insights on how disruptive technologies are reshaping global growth opportunities. They shared perspectives on the rapid maturation of innovation - from AI and biotech to digital assets - into scalable, investable markets, and highlighted how new investment vehicles are opening greater access for investors worldwide.

The President and Chief Executive Officer of Franklin Templeton, Ms Jenny Johnson, predicted that the next wave of major companies will emerge from the AI and crypto innovation. She emphasised that while AI and blockchain are transformative, the biggest challenge is organisational change management, where start-ups adapt faster than incumbents. Ms Johnson noted that current AI investment gains are concentrated among infrastructure providers such as chipmakers and cloud services, but future growth will come as firms learn to expand margins using AI. She also highlighted real-world crypto and NFT (non-fungible token) applications, such as luxury goods authentication and bandwidth sharing, and praised Hong Kong's progressive blockchain regulation as a model for innovation.

The President of the Solana Foundation, Ms Lily Liu, discussed how digital asset treasury (DATs) and ETFs (exchange-traded funds) are complementary tools for traditional investors, but stressed the need to filter them for long-term quality amid speculative cycles. She highlighted how the evolution of technologies such as stablecoins reflects a broader transformation in financial infrastructure, where decentralised platforms increasingly play a central role in profit generation and capital flow. On another panel, Co-Executive Director of the Ethereum Foundation Mr Tomasz Stańczak, emphasised stablecoins' role in improving cross-border payments and driving institutional interest in tokenised assets.

During the main conference, a series of curated media tours highlighted Hong Kong's role as a global financial and innovation hub. Key moments included exclusive sessions with Chinese Mainland tech giants. Tencent introduced its vision for cross-boundary payment services; WeBank focused on HQ-driven innovation; and Ant Digital Technologies underscored Hong Kong's strategic advantages for global expansion and cutting-edge fintech solutions. Other tours showcased Hong Kong as a "super connector" for emerging markets with delegations led by the Dubai International Financial Centre and the National Innovation Agency of Thailand. Another tour positioned Hong Kong as a launch pad for Chinese Mainland firms to go global, featuring the Shenzhen Financial Techology Association and the Zhongguancun Financial Technology Industry Development Alliance.

Marking the conclusion of the HKFW x SMUF 2025, Ms Lau, said, "The unprecedented success of the HKFW x SMUF 2025 speaks volumes about the vibrancy, depth and resilience of our financial innovation and start-up ecosystem. We are grateful to all our partners, speakers and participants from around the world who came together to make this our largest and most impactful edition yet. As we look to the next decade, InvestHK remains steadfast in our commitment to connect global companies with Hong Kong's dynamic ecosystem, empowering them to scale across Asia and beyond, driving innovation, commercialisation, and creating more cross-border collaboration opportunities."

For more details and highlights from HKFW x SMUF 2025, please visit www.fintechweek.hk, or follow via the official social media accounts:

LinkedIn: Hong Kong FinTech Week; and

YouTube: www.youtube.com/c/HongKongFinTechWeek.

BERITA LAINNYA

Selasa, 18 November 2025 | 20:19

Selasa, 18 November 2025 | 20:18

Selasa, 18 November 2025 | 20:17

Selasa, 18 November 2025 | 20:16

Selasa, 18 November 2025 | 20:15

Selasa, 18 November 2025 | 20:15

Selasa, 18 November 2025 | 20:14

Selasa, 18 November 2025 | 20:11

Selasa, 18 November 2025 | 20:09

Selasa, 18 November 2025 | 20:07

Selasa, 18 November 2025 | 19:56

Selasa, 18 November 2025 | 10:56