- Home

- MediaOutReach

- CPA Australia Survey: Increasing AI Adoption Reshapes Future Roles in Accounting Industry and Rises Data Concerns in Hong Kong

CPA Australia Survey: Increasing AI Adoption Reshapes Future Roles in Accounting Industry and Rises Data Concerns in Hong Kong

Selasa, 11 November 2025 | 07:52

HONG KONG SAR -

Media OutReach Newswire

- 10 November 2025 - CPA Australia's regional survey about business

technology adoption shows that most companies in Hong Kong have used

artificial intelligence (AI) tools at different levels. Though the

increasing AI application helps to improve productivity, it also

transforms the hiring trends in the accounting and finance industry, and

increases concerns on data protection and governance, according to the

survey findings.

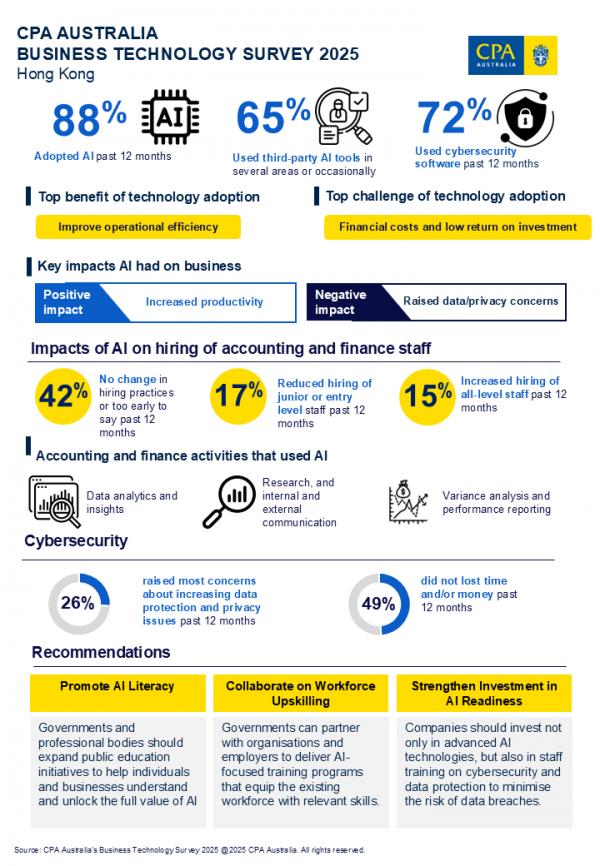

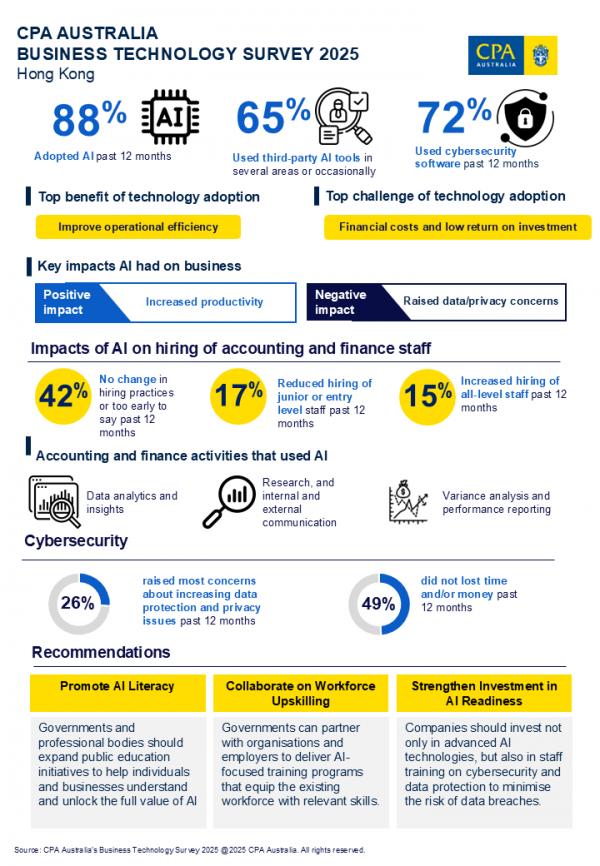

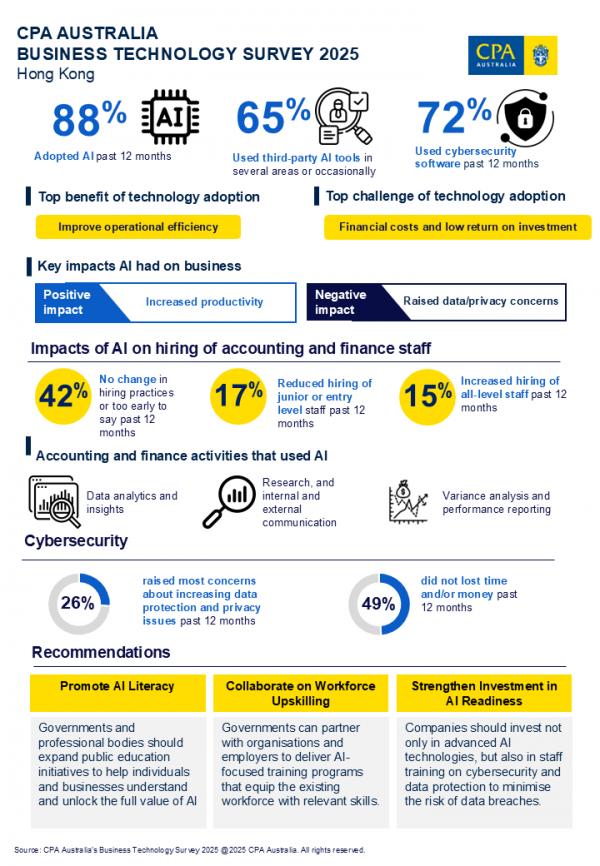

The result indicates the notable growth of AI adoption across markets in Asia Pacific, with 89 per cent of respondents said that they have adopted AI in the past 12 months, up from 69 per cent last survey. In Hong Kong, 88 per cent have applied AI such as ChatGPT, Copilot at the workplace. When asked about the level of AI adoption, 65 per cent respondents primarily used third-party tools in several areas or occasionally.

Dr Paul Sin, CPA Australia's Greater China Councillor and Chair of Web3 & Emerging Technology Committee highlighted the gap between the awareness of AI and releasing the real value of AI, "Most respondents said that they used third-party AI tools, implying that the awareness of AI in Hong Kong is high. Yet, many companies are still at the Proof-of-Concept stage, which means they just use AI tools to improve productivity like handling repetitive tasks and automate process. In fact, the government and professional organisations can do more education to unleash the true value of AI, for example, to reinvent business models or transform workflows by using more advanced solutions like predictive analytics and agentic AI, eventually scale up to production-grade implementation to align with their strategic goals."

The increasing prevalence of AI is transforming the recruitment trends across various industries including accounting and finance. While 42 per cent of respondents in Hong Kong said that there has been no change in hiring practices, or that is too early to say, 17 per cent said that their organisations have reduced the number of junior-level staff hired for the accounting and finance teams due to the adoption of AI.

Dr Sin highlighted the correlation between the hiring trend and the tasks being replaced by AI, "Survey shows that most respondents use AI for data analytics and research in their accounting and finance activities, and these tasks are usually carried out by junior staff. Clearly, AI can free them up from repetitive and tedious tasks, allowing them focus on more human-centric or strategic responsibilities such as advisory, decision-making and client engagement. The underlying skills are difficult to replace with technology such as creativity and judgement built from business experience. Grooming junior staff to take on these more advanced responsibilities takes time, so employers should consider balancing adoption of advanced technology with talent development for the organisation's long-term growth."

Dr Albert Wong, Deputy Chair of CPA Australia's Greater Bay Area Committee added on, "AI is only replacing certain tasks, not humans. As AI develops, the recruitment standard for technical skills is rising because some tasks can be done effectively by technology. Employers will expect their future staff to be able to work alongside with AI to solve problems, use these technology solutions to add value to existing services and products, generate new ideas/options, and predict the future in various scenarios. The job market will become more competitive. Therefore, the younger generation and the existing employees must develop irreplaceable skills, particularly soft skills such as human-human and human-machine interaction, effective communication, creative and critical thinking, and professional scepticism."

To keep up with the transformation, the Hong Kong SAR Government has an instrumental role to play. He called for policy support to build a future-ready workforce in Hong Kong. "The Government could collaborate with organisations and employers to upskill existing workforce on AI-centric training; offer subsidies to encourage SMEs to pilot/adopt different types of AI in their businesses and create internship schemes that give university students the opportunity to apply AI tools to real-world problem-solving."

Data is the new oil for technology. Among the surveyed markets, Hong Kong respondents raised the most concerns about increasing data protection and privacy issues (26 per cent) from AI adoption. On a positive note, 72 per cent said that they had implemented cybersecurity in the past 12 months, and Hong Kong's overall cybersecurity maturity is considerably high.

Mr Winson Woo, a member of CPA Australia's Greater Bay Area Committee shared his views on data protection and governance, "Many technologies already have embedded AI functions, so AI adoption will continue to increase in the future. Organisations should establish an AI development roadmap to plan how to apply AI to achieve strategic goals, and how to measure the return of investment, as well as setting clear governance guidelines to ensure the ethical use of AI tools in the workplace."

When discussing cybersecurity, he highlighted two emerging trends: Manage Security Operations Center (MSOC), a model of outsourcing security operations center (SOC) functions to third-party service providers to perform real-time detection and monitoring of cyber attacks and threats; and AI security, which protects AI systems from data breaches and misuse. He also emphasised the importance of staff training in data protection, "To reduce the risk of data leakage, companies should invest not only in technical software, but also in enhancing staff's security awareness, to ensure that AI users understand which authorised data can be used in AI tools and which sensitive information cannot be disclosed."

Mr Woo believes that the introduction of guidelines and regulations, such as the Personal Data (Privacy) Ordinance and the Protection of Critical Infrastructure (Computer System) Ordinance, will help to create an ethical environment that promotes innovation and technology in Hong Kong.

The survey collected responses from 1,117 accounting and finance professionals across markets in the Asia-Pacific such as Australia, mainland China, including 154 responses from Hong Kong.

The result indicates the notable growth of AI adoption across markets in Asia Pacific, with 89 per cent of respondents said that they have adopted AI in the past 12 months, up from 69 per cent last survey. In Hong Kong, 88 per cent have applied AI such as ChatGPT, Copilot at the workplace. When asked about the level of AI adoption, 65 per cent respondents primarily used third-party tools in several areas or occasionally.

Dr Paul Sin, CPA Australia's Greater China Councillor and Chair of Web3 & Emerging Technology Committee highlighted the gap between the awareness of AI and releasing the real value of AI, "Most respondents said that they used third-party AI tools, implying that the awareness of AI in Hong Kong is high. Yet, many companies are still at the Proof-of-Concept stage, which means they just use AI tools to improve productivity like handling repetitive tasks and automate process. In fact, the government and professional organisations can do more education to unleash the true value of AI, for example, to reinvent business models or transform workflows by using more advanced solutions like predictive analytics and agentic AI, eventually scale up to production-grade implementation to align with their strategic goals."

The increasing prevalence of AI is transforming the recruitment trends across various industries including accounting and finance. While 42 per cent of respondents in Hong Kong said that there has been no change in hiring practices, or that is too early to say, 17 per cent said that their organisations have reduced the number of junior-level staff hired for the accounting and finance teams due to the adoption of AI.

Dr Sin highlighted the correlation between the hiring trend and the tasks being replaced by AI, "Survey shows that most respondents use AI for data analytics and research in their accounting and finance activities, and these tasks are usually carried out by junior staff. Clearly, AI can free them up from repetitive and tedious tasks, allowing them focus on more human-centric or strategic responsibilities such as advisory, decision-making and client engagement. The underlying skills are difficult to replace with technology such as creativity and judgement built from business experience. Grooming junior staff to take on these more advanced responsibilities takes time, so employers should consider balancing adoption of advanced technology with talent development for the organisation's long-term growth."

Dr Albert Wong, Deputy Chair of CPA Australia's Greater Bay Area Committee added on, "AI is only replacing certain tasks, not humans. As AI develops, the recruitment standard for technical skills is rising because some tasks can be done effectively by technology. Employers will expect their future staff to be able to work alongside with AI to solve problems, use these technology solutions to add value to existing services and products, generate new ideas/options, and predict the future in various scenarios. The job market will become more competitive. Therefore, the younger generation and the existing employees must develop irreplaceable skills, particularly soft skills such as human-human and human-machine interaction, effective communication, creative and critical thinking, and professional scepticism."

To keep up with the transformation, the Hong Kong SAR Government has an instrumental role to play. He called for policy support to build a future-ready workforce in Hong Kong. "The Government could collaborate with organisations and employers to upskill existing workforce on AI-centric training; offer subsidies to encourage SMEs to pilot/adopt different types of AI in their businesses and create internship schemes that give university students the opportunity to apply AI tools to real-world problem-solving."

Data is the new oil for technology. Among the surveyed markets, Hong Kong respondents raised the most concerns about increasing data protection and privacy issues (26 per cent) from AI adoption. On a positive note, 72 per cent said that they had implemented cybersecurity in the past 12 months, and Hong Kong's overall cybersecurity maturity is considerably high.

Mr Winson Woo, a member of CPA Australia's Greater Bay Area Committee shared his views on data protection and governance, "Many technologies already have embedded AI functions, so AI adoption will continue to increase in the future. Organisations should establish an AI development roadmap to plan how to apply AI to achieve strategic goals, and how to measure the return of investment, as well as setting clear governance guidelines to ensure the ethical use of AI tools in the workplace."

When discussing cybersecurity, he highlighted two emerging trends: Manage Security Operations Center (MSOC), a model of outsourcing security operations center (SOC) functions to third-party service providers to perform real-time detection and monitoring of cyber attacks and threats; and AI security, which protects AI systems from data breaches and misuse. He also emphasised the importance of staff training in data protection, "To reduce the risk of data leakage, companies should invest not only in technical software, but also in enhancing staff's security awareness, to ensure that AI users understand which authorised data can be used in AI tools and which sensitive information cannot be disclosed."

Mr Woo believes that the introduction of guidelines and regulations, such as the Personal Data (Privacy) Ordinance and the Protection of Critical Infrastructure (Computer System) Ordinance, will help to create an ethical environment that promotes innovation and technology in Hong Kong.

The survey collected responses from 1,117 accounting and finance professionals across markets in the Asia-Pacific such as Australia, mainland China, including 154 responses from Hong Kong.

BERITA LAINNYA

Selasa, 11 November 2025 | 07:55

Selasa, 11 November 2025 | 07:54

Selasa, 11 November 2025 | 07:53

Selasa, 11 November 2025 | 07:52

Selasa, 11 November 2025 | 07:50

Senin, 10 November 2025 | 14:09

Senin, 10 November 2025 | 14:07

Senin, 10 November 2025 | 10:29

Senin, 10 November 2025 | 10:27

Senin, 10 November 2025 | 10:25