- Home

- MediaOutReach

- Gold's Stellar Growth May Have Reached its Finale, Says VT Markets Latest 2025 Q1 Economic Outlook

Gold's Stellar Growth May Have Reached its Finale, Says VT Markets Latest 2025 Q1 Economic Outlook

Kamis, 09 Januari 2025 | 11:44

HONG KONG SAR -

Media OutReach Newswire - 9 January 2025 - Award-winning brokerage

VT Markets, a global leader in financial services, has released its

2025 Q1 Economic Outlook. In the report, the broker spotlights

the remarkable trajectory of gold in 2024 and its potential market

performance in the coming year. The report further delves into key

drivers of gold's price movement; an explainer on why the precious metal

is regarded as a safe-haven asset amidst heightened global uncertainty

last year.

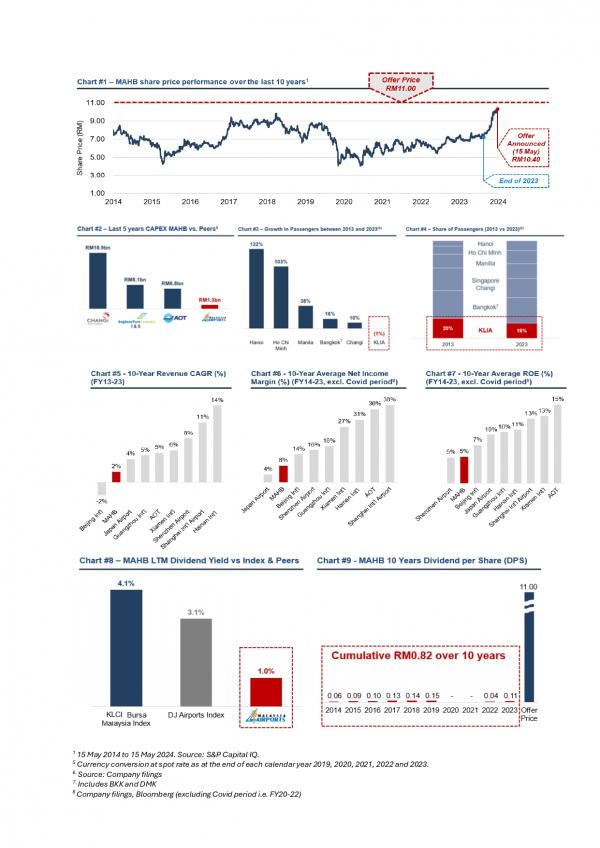

2024: A Record-Breaking Year for Gold

Gold first emerged as a focal point for investors in 2024, reaching unprecedented heights of $2,790 per ounce during the U.S. presidential election period. Unsurprisingly, this all-time high was propelled by market volatility and escalating geopolitical tensions. While gold prices retraced by over $200 following the election, prices stabilised above $2,600 per ounce, closing the year with a noteworthy 27% annual gain. VT Markets highlighted this as a testament to gold's resilience and its pivotal role in hedging against uncertainty.

Key Catalysts for Gold's Stellar Performance

The VT Markets' research desk attributes gold's extraordinary performance to three primary factors:

Central Bank De-Dollarisation

Gold demand surged as BRICS nations, including China and Russia, advanced de-dollarisation initiatives. Gold reserves within these economies climbed from 4,360 metric tons in 2018 to nearly 5,550 metric tons by 2024. Emerging markets, such as Turkey, Poland, and India, also contributed significantly to central bank gold purchases—a trend forecasted to continue into 2025 with expected demand exceeding 500 tons.

Geopolitical Instability Elevating Safe-Haven Demand

The irreversible trend of de-globalisation has heightened geopolitical risks, which in turn has further cementing gold's allure. For one, the re-election of Donald Trump as U.S. President and his unilateral policy approaches are likely to perpetuate uncertainty this year. While short-term peace initiatives, such as potential Russo-Ukrainian negotiations, may temporarily temper gold prices, VT Markets foresees sustained demand due to the prolonged nature of geopolitical conflicts.

The Federal Reserve's Monetary Policy Shift

The Federal Reserve's pivot to rate cuts in September 2024 also sparked renewed interest in gold. Historical trends indicate that gold prices typically peak within two quarters of a rate cut cycle. VT Markets predicts that gold will retain upward momentum through early 2025, though its annual growth may taper as markets absorb the impact of monetary easing.

Looking Ahead: Stabilisation Amid Uncertainty

While 2024 was undeniably a banner year for gold, VT Markets anticipates a period of consolidation in 2025. The research team projects a high yet steady price trajectory, with reduced volatility compared to the previous year's highs. Despite this, gold remains a critical asset in diversified investment strategies, particularly in uncertain economic climates.

https://www.linkedin.com/company/89310903/admin/feed/posts/

https://www.facebook.com/VTMarketsCN

https://www.instagram.com/vtmarkets/

2024: A Record-Breaking Year for Gold

Gold first emerged as a focal point for investors in 2024, reaching unprecedented heights of $2,790 per ounce during the U.S. presidential election period. Unsurprisingly, this all-time high was propelled by market volatility and escalating geopolitical tensions. While gold prices retraced by over $200 following the election, prices stabilised above $2,600 per ounce, closing the year with a noteworthy 27% annual gain. VT Markets highlighted this as a testament to gold's resilience and its pivotal role in hedging against uncertainty.

Key Catalysts for Gold's Stellar Performance

The VT Markets' research desk attributes gold's extraordinary performance to three primary factors:

Central Bank De-Dollarisation

Gold demand surged as BRICS nations, including China and Russia, advanced de-dollarisation initiatives. Gold reserves within these economies climbed from 4,360 metric tons in 2018 to nearly 5,550 metric tons by 2024. Emerging markets, such as Turkey, Poland, and India, also contributed significantly to central bank gold purchases—a trend forecasted to continue into 2025 with expected demand exceeding 500 tons.

Geopolitical Instability Elevating Safe-Haven Demand

The irreversible trend of de-globalisation has heightened geopolitical risks, which in turn has further cementing gold's allure. For one, the re-election of Donald Trump as U.S. President and his unilateral policy approaches are likely to perpetuate uncertainty this year. While short-term peace initiatives, such as potential Russo-Ukrainian negotiations, may temporarily temper gold prices, VT Markets foresees sustained demand due to the prolonged nature of geopolitical conflicts.

The Federal Reserve's Monetary Policy Shift

The Federal Reserve's pivot to rate cuts in September 2024 also sparked renewed interest in gold. Historical trends indicate that gold prices typically peak within two quarters of a rate cut cycle. VT Markets predicts that gold will retain upward momentum through early 2025, though its annual growth may taper as markets absorb the impact of monetary easing.

Looking Ahead: Stabilisation Amid Uncertainty

While 2024 was undeniably a banner year for gold, VT Markets anticipates a period of consolidation in 2025. The research team projects a high yet steady price trajectory, with reduced volatility compared to the previous year's highs. Despite this, gold remains a critical asset in diversified investment strategies, particularly in uncertain economic climates.

https://www.linkedin.com/company/89310903/admin/feed/posts/

https://www.facebook.com/VTMarketsCN

https://www.instagram.com/vtmarkets/

BERITA LAINNYA

Kamis, 09 Januari 2025 | 11:45

Kamis, 09 Januari 2025 | 11:44

Kamis, 09 Januari 2025 | 11:42

Kamis, 09 Januari 2025 | 11:40

Kamis, 09 Januari 2025 | 11:40

Kamis, 09 Januari 2025 | 08:13

Kamis, 09 Januari 2025 | 08:10

Kamis, 09 Januari 2025 | 08:09

Kamis, 09 Januari 2025 | 08:07